THG Share Price Chat: Trends, Insights, and Future Outlook

THG Share Price Chat: A Deep Dive into the Current Market Trends and Future Outlook

The world of stock trading is a complex, dynamic environment where investors constantly seek new opportunities, and one area that has garnered attention recently is the performance of The Hut Group (THG). The company, known for its leading e-commerce and technology platform, has witnessed substantial fluctuations in its share price over the years. In this post, we will delve into the current trends surrounding the THG share price, analyze key factors affecting it, and offer insights into its potential future trajectory. If you’re looking to understand THG’s market movements and gain insight into whether it’s a good time to invest, this article will give you all the information you need.

The Hut Group: A Brief Overview

Before diving into the specifics of the THG share price chat, it’s important to understand a bit about The Hut Group itself. Founded in 2004, THG has rapidly grown into a global leader in e-commerce, focusing primarily on the health and beauty sector. The company operates a variety of well-known brands, such as Myprotein, ESPA, and Lookfantastic, which contribute significantly to its overall revenue.

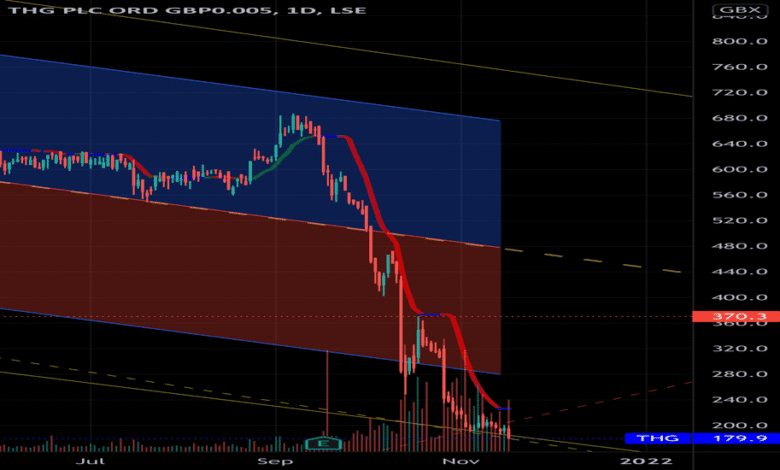

The company went public in 2020, listing its shares on the London Stock Exchange (LSE) with the ticker symbol “THG.” Despite its strong presence in the market and its significant global expansion, the stock has seen a rollercoaster ride in terms of share price performance. From the high expectations that followed its initial public offering (IPO) to the dips that have followed, investors have been closely watching its movements. The conversation around THG share price is often filled with speculation about its future prospects, making it a topic worth exploring.

Understanding the Volatility of THG Share Price

One of the most intriguing aspects of THG’s stock is its volatility. After its IPO, THG share price initially soared, reflecting optimism about the company’s future growth prospects. However, the stock has experienced several periods of sharp declines and rallies. The factors contributing to this volatility are varied, but understanding them is key to interpreting THG share price movements.

Market Sentiment and Investor Perception

Investor sentiment plays a major role in determining the price of stocks. In the case of THG, the market’s perception of its future growth potential has fluctuated based on various factors, including its financial performance, business model, and external economic conditions. When THG has reported strong earnings or made strategic acquisitions, investors have been quick to show confidence, driving the share price up. On the other hand, when the company faced operational challenges or experienced disappointing earnings results, sentiment turned negative, contributing to downward pressure on the stock.

The Impact of Corporate Developments

Corporate developments can also significantly impact THG share price. Over the years, the company has made several strategic decisions, such as acquisitions and investments in technology. For instance, THG’s decision to launch THG Ingenuity, a technology platform to help other businesses build and scale their e-commerce operations, was seen as a major move. Such initiatives have led some investors to view the company as a technology-driven e-commerce giant. However, these decisions also come with risks, and any missteps could lead to negative investor reactions, affecting the stock price.

Additionally, the broader market environment, including changes in interest rates, inflation, and economic growth prospects, can influence investor sentiment. For example, during periods of economic uncertainty, growth stocks like THG may experience heightened volatility.

Key Factors Driving the Current THG Share Price Trends

To understand where the THG share price is headed, it’s essential to look at the key factors currently influencing the stock. These factors include:

Performance in E-Commerce and Consumer Trends

THG’s core business revolves around e-commerce, and as the world becomes increasingly digital, consumer behavior plays a vital role in shaping the company’s revenue. E-commerce growth in the health and beauty sectors has been robust, and THG has positioned itself well to benefit from this trend. However, it is also crucial to consider broader market dynamics, such as shifts in consumer spending patterns or competition from other major players in the industry.

Financial Results and Profitability

Another crucial factor influencing THG share price is the company’s financial performance. In recent years, THG has focused heavily on expanding its product offerings and improving profitability. Its quarterly earnings reports often become a focal point for investors, as strong results can send the share price higher, while disappointing figures can lead to sell-offs. Given that THG is still in the growth phase, its ability to balance expansion with profitability is a key concern for shareholders.

Regulatory and Market Challenges

As a publicly listed company, THG is subject to regulatory scrutiny and market challenges. This includes compliance with laws related to e-commerce, privacy, and international trade. Additionally, fluctuations in foreign exchange rates can impact the company’s profitability, especially as it has a global reach. Any regulatory changes or challenges in international markets could affect investor confidence and, in turn, the share price.

Leadership Changes and Strategic Direction

Changes in leadership and strategic direction can also have a significant impact on THG share price. For instance, the founder and CEO of the company, Matthew Moulding, has been a driving force behind its success. Any news of leadership changes or shifts in strategic vision could lead to shifts in investor confidence, potentially affecting the stock price. It’s important for investors to keep an eye on leadership dynamics and how they influence company policy.

THG Share Price Chat: Analyzing Trends and Predictions

Given the various factors at play, it’s helpful to look at recent trends and predictions for THG share price. Over the past year, THG has faced some significant challenges in terms of stock price performance. However, the company has also shown resilience, with occasional recoveries following major price drops.

Currently, analysts have mixed views on the stock. Some are optimistic about THG’s long-term growth potential, particularly due to its robust position in the e-commerce and health sectors. Others are more cautious, pointing to challenges such as competition, economic volatility, and the company’s reliance on technology investments.

Short-Term vs. Long-Term Outlook

In the short term, the volatility of THG share price could continue, particularly as market sentiment fluctuates based on quarterly earnings and macroeconomic factors. However, for long-term investors, the stock’s current price may present an attractive entry point, especially if they believe in the company’s ability to navigate its challenges and continue its growth trajectory.

External Analysts and Their Predictions

Industry analysts have varied predictions for THG’s future. Some analysts predict steady growth, driven by continued demand for health and beauty products and the company’s strong digital presence. Others believe that the stock may struggle to break free from its volatility, especially if market conditions worsen. Ultimately, the success of THG will depend on how well the company executes its strategy and adapts to changing market conditions.

Conclusion: Should You Buy or Sell THG Shares?

The question on many investors’ minds is whether now is a good time to buy or sell THG shares. While the stock has been volatile in recent years, it also presents opportunities for those willing to take on risk. For investors with a long-term perspective, the current price may offer a compelling entry point, especially given the company’s position in the e-commerce space. However, those with a short-term focus should be prepared for continued price fluctuations.

As with any stock, it’s important to do your own research and consider your risk tolerance before making any investment decisions. THG share price remains an intriguing topic of discussion, and its future will depend largely on how well the company navigates both market challenges and internal growth initiatives.

FAQ: Common Questions About THG Share Price

1. What factors influence the THG share price?

The THG share price is influenced by a range of factors, including company performance, market sentiment, investor perception, leadership changes, and broader economic conditions.

2. Is THG stock a good investment?

Whether THG stock is a good investment depends on your risk tolerance and investment strategy. For long-term investors, the stock may offer growth potential, while short-term investors should be cautious due to its volatility.

3. Why has the THG share price been volatile?

The THG share price has been volatile due to factors such as market sentiment, financial performance, competition in the e-commerce sector, and broader economic conditions.

4. What is the future outlook for THG shares?

The future outlook for THG shares is mixed, with some analysts optimistic about long-term growth, while others caution against short-term volatility. The stock’s performance will depend on how well the company executes its strategy and adapts to market conditions.

5. How can I track THG share price movements?

THG share price movements can be tracked using financial news websites, stock market apps, and platforms like the London Stock Exchange website, which provide real-time updates and historical data.

Discovering hugo bachega accent: A Blend of Brazilian and British Influences